Banking & Finance

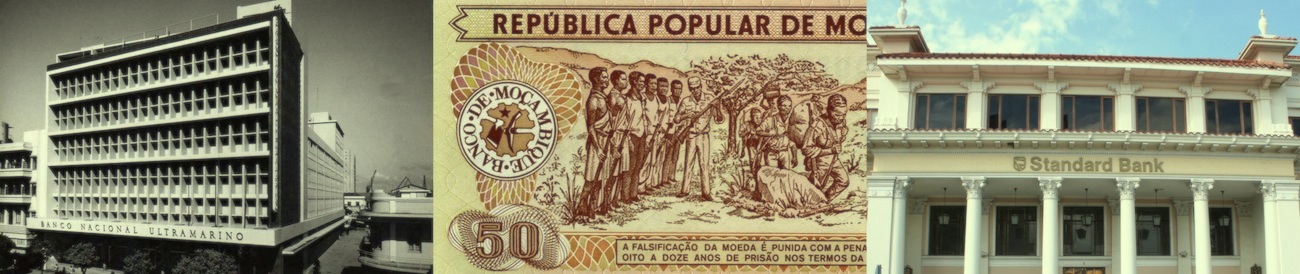

Background

In the early 1990s Mozambique renounced its communist and socialist ideologies. This and the national peace agreement in 1992 led to a more optimistic outlook for the country's economy. The GDP rate growing at an average of 7% is one of the best in Africa and has encouraged the entry of banks primarily from the European continent.

There are currently 19 banks in Mozambique including micro-finance lending providers. However, about 3 banks which are internationally owned take up the bulk of the banking market. The industry in Mozambique is highly profitable due to the interest rates which are some of the highest in the world.

These institutions also tend to be conservative which limits the extent to which banking services are used overall. It is estimated that over 80% of the working population does not utilize banking services. Aside from the high interest rates impeding growth, banking facilities such as ATMs and branches are concentrated in urban centres where the investments are more likely to pay off.

Development Challenges

While the growth in the banking sector is highly lucrative and second only to the extractive industry, the following challenges still need to be overcome:

Mobile Banking

Mozambique like many developing economies has been able to substitute traditional banking facilities with more innovative solutions. Mobile banking has seen more success across the continent, and in Mozambique the two largest mobile operators have launched mobile money platforms.

These platforms remove many of the existing physical constraints associated with bank branches and ATMs by offering access to the services in rural areas and to clients who make small transactions.

Tax Insights

By way of comparison to other industries in Mozambique, agriculture is suitably better positioned for attracting investments and should do well. In practice the following factors, both favorable and unfavorable exist: